san francisco sales tax rate

This is the total of state and county sales tax rates. The minimum combined 2022 sales tax rate for South San Francisco California is.

Sales Tax Rates Reached 10 Year High In 2020 Accounting Today

The current total local sales tax rate in San Francisco CA is 8625.

. The minimum combined sales tax rate for San Francisco California is 85. The December 2020 total local sales tax rate was 8500. The San Francisco County Transportation Authority which administers the half-cent sales tax program has sponsored Prop.

This is the total of state county and city sales tax. The minimum combined 2022 sales tax rate for San Francisco County California is. L to continue the tax approve a new 30-year investment plan.

The rates display in the files below represents total Sales and Use Tax Rates state local county and district where applicable. The current total local sales tax rate in San Francisco County CA is 8625. This includes the rates on the state county city and special levels.

Please visit our State of Emergency Tax Relief page for. To view a history of the statewide sales and use tax rate please. The December 2020 total local sales tax rate was 8500.

The local sales tax rate in San Francisco Puerto Rico is 8625 as of September 2022. This is the total of state county and city sales tax rates. Name A - Z Sponsored Links.

This is the total of state county and city sales tax rates. What is the sales tax rate in San Francisco California. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

The California state sales tax rate is currently. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025. Voter-approved Proposition 30 The Schools and Local Public Safety Protection Act of 2012 which imposed the one quarter of one percent 025 percent temporary statewide.

The current total local sales tax rate in South San Francisco CA is 9875. The average cumulative sales tax rate in San Francisco California is 864. The California sales tax rate is currently 6.

Sales Tax Rate in San Francisco CA. 0875 lower than the maximum sales tax in CA. This scorecard presents timely.

The 8625 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 2375. There is no applicable city tax. This is the total of state county and city sales tax rates.

How much is sales tax in San Francisco. This is the total of state county and city sales. Choose Avalara sales tax rate tables by state or look up individual rates by address.

1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. The December 2020 total local sales tax rate was 9750. The minimum combined 2022 sales tax rate for San Francisco Colorado is 39.

What is the sales tax rate in San Francisco Colorado. The minimum combined sales tax rate for San Francisco California is 85. State Government Sales Use Tax.

San Francisco County California Sales Tax Rate 2022 Up to 9875. There is the regular state sales tax of 6 percent and the regular Alameda County sales tax of 3 25 special district sales tax used. Ad Free Avalara tools include monthly rate table downloads and a sales tax rate calculator.

Sales Tax Rate For San Francisco Ca. The minimum combined 2022 sales tax rate for San Francisco California is. What is the sales tax rate in South San Francisco California.

San Francisco has parts of it located within. A county-wide sales tax rate of 025 is applicable to localities in San Francisco County in addition to the 6 California. The purpose of the Economy scorecard is to provide the public elected officials and City staff with a current snapshot of San Franciscos economy.

California Taxes A Guide To The California State Tax Rates

San Francisco California Proposition I Real Estate Transfer Tax November 2020 Ballotpedia

San Jose Millennials Pay Some Of The Highest Effective Tax Rates In The Nation Along With San Francisco East Coast Cities Silicon Valley Business Journal

San Francisco Prop K Sales Tax For Transportation And Homelessness Spur

Joe Bruno On Twitter Via Statesman Cost Of The Tax Increase In Austin A 339 Increase For A 415 000 Home The Median Sales Price Https T Co Qxhrb4h8ix Twitter

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Jpr007 On Twitter And The Plot Thickens The Tax Rate Is For New York City And The Original Receipt Was For Overstaying At A Supercharger In Brooklyn Ny Https T Co Jsod3il09r Twitter

City Budgets In An Era Of Increased Uncertainty

Worst In The State S F Sales Tax Data Show Likely Population Decline

San Francisco Property Tax Rate Set To Drop 0 23 Percent

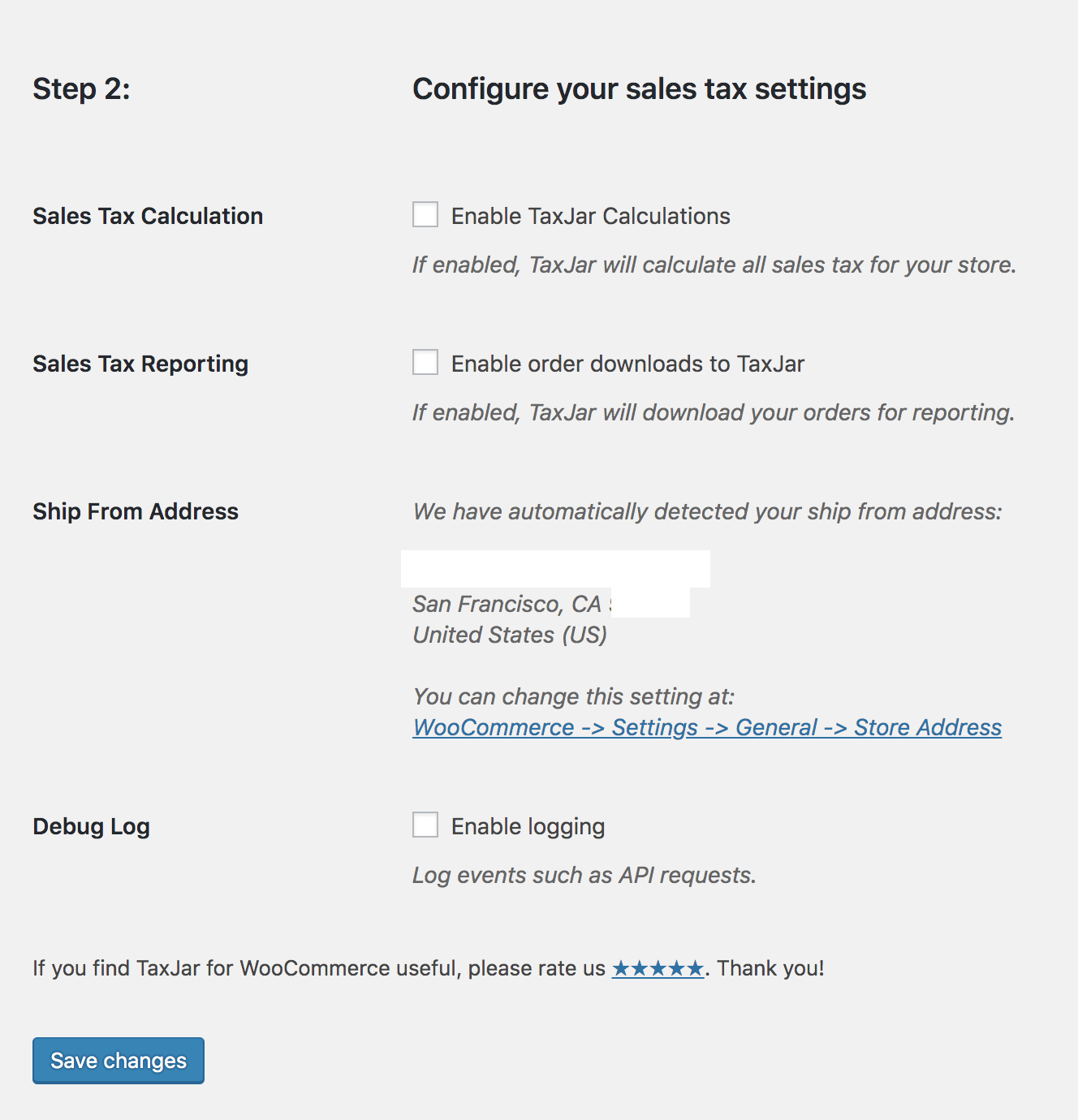

Taxjar For Woocommerce Woocommerce

How Low Taxes Lead To High Home Prices In Vancouver Bc Sightline Institute

Short Term And Long Term Capital Gains Tax Rates By Income

California Sales Tax Rate Changes January 2013 Avalara

San Francisco S Sourcing Rules For Computing The Gross Receipts Tax